A Guide to Green Energy Adoption for Transit Agencies Chapter 4: Procurement Options for Green Energy

- Date: February 16, 2022

Jump to section

The growth of the renewable energy industry has benefited organizations seeking to procure green energy to power their own operations. Historically, organizations were dependent on whatever electricity was provided to them via the local electric utility. Electric utilities often built large power generating stations to serve a multitude of customers, and choices regarding how clean that energy production was did not exist for the customer. As the renewable energy industry has matured, more procurement options have been developed, making green energy now accessible to agencies that may not have green power sources available via their local electric utility in the past.

Transit agencies can now access green energy resources through options that provide flexibility for varying degrees of financial resources, physical constraints, and levels of operational control. Many electric utilities offer green power options through green power products and green power tariffs. For agencies with the available upfront capital and desire for more operational control over their energy supply, procuring and installing on-site green power generation is a viable option. In other instances, non-utility third-party energy providers can supply green power through energy-as-a-service business models.

Within these three green energy procurement options exist a range of choices that an agency should research before making a decision. The power needs of the operation, contractual terms, and state and local regulations are just a few of the considerations an agency may need to research to decide which green energy supply option is right. Some options may be limited depending on geography or jurisdiction. For instance, green energy tariffs are an option in regulated electricity markets but may not be available in unregulated markets. This chapter of the Green Energy Guide seeks to provide an overview of green energy procurement options available to transit agencies. For each of these options, collaborating with your local electric utility is highly recommended and often necessary. Please see N-CATT’s whitepaper, Building Successful Partnerships between Rural Transit Systems Deploying Zero-Emission Vehicles and their Electric Utilities for approaches.

Utility Green Power Programs

The easiest place to start exploring green energy procurement options is looking into what the local electric utility or electric providers in the area offer. Many utilities are beginning to offer programs for customers, both residential and commercial, that want to purchase green energy to power their homes or businesses. Two common green power programs that are gaining traction among utility offerings are green power tariffs and green power products.

Green Power Tariffs

Transit agencies may have access to green tariff programs through their usual electric utility. Utility green tariffs are programs that offer commercial and industrial customers, like transit agencies, the option to buy green energy under a special utility tariff rate. If eligible for a green tariff program, a transit agency could buy up to 100 percent renewable power from the utility. The utility supplies this renewable power from renewable projects owned by the utility or from independent, third-party power producers connected to the regional grid.

The mechanism through which a utility procures and delivers green energy to a green tariff customer varies. Depending on the circumstances and the particulars of the utility program, the green tariff may manifest as a market-based utility rate or as a utility-facilitated power purchase agreement (see section on power purchase agreements below). Agencies interested in such programs should contact their local electricity provider to see what green tariff options, if any, exist in their service area.

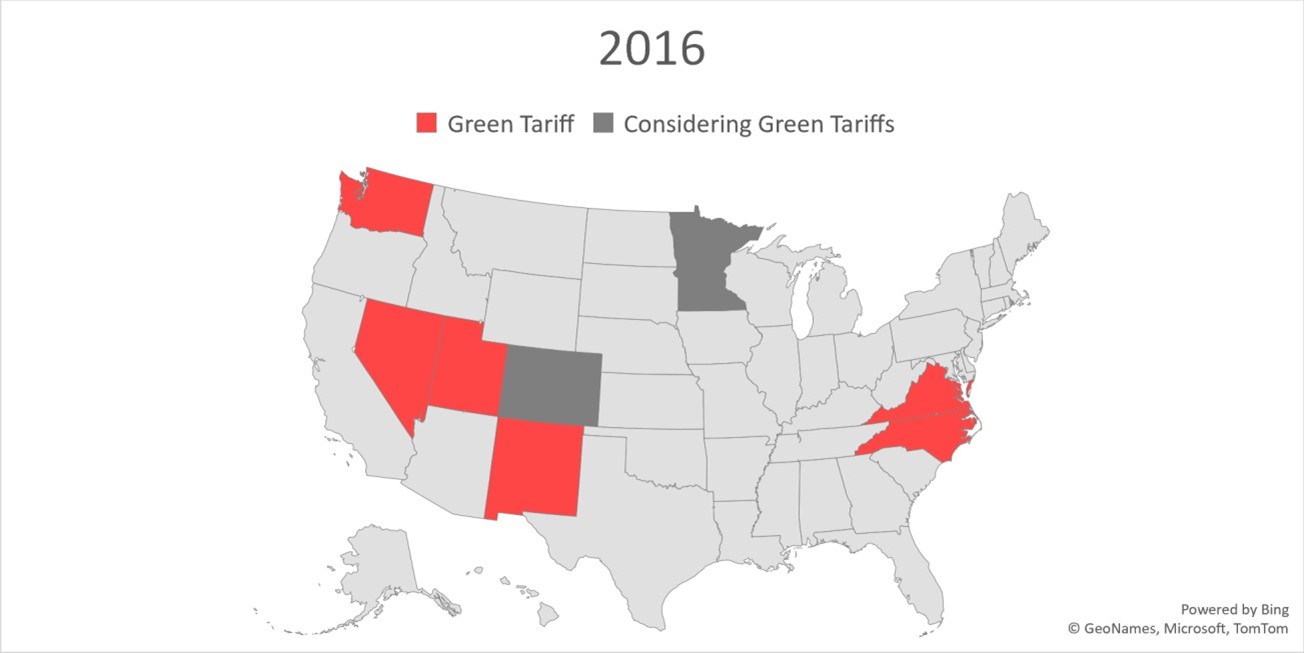

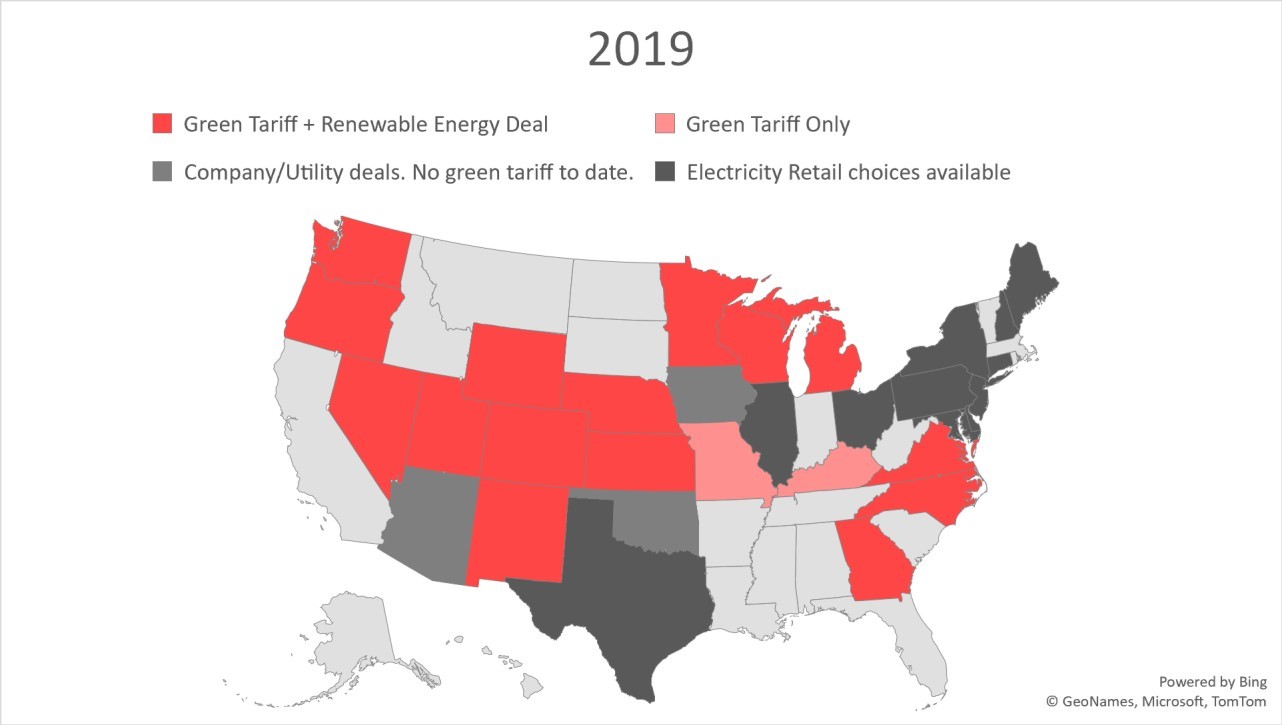

These tariffs are available only in certain states and through certain utilities. Each green power tariff will have specific requirements depending on the utility company that administers them. These programs are increasing in popularity across the country; in the last six years, these programs have grown from being available in six states in 2017 to being available in 15 states as of 2020.

For an updated resource on currently available green tariff programs, please see World Resources Institute’s “Map of U.S. Green Tariffs and Utility Renewable Energy Solutions for Large Buyers.”

Utility Green Power Products

Utility green power products are similar programs to green power tariffs but operate slightly differently. While green power tariffs require longer-term commitments to purchase power from specific projects, green power product programs are shorter-term, and customers can often unsubscribe at any given time as subscriptions are month to month. Under a utility green power product program, customers typically pay a cost premium on their utility bill to support the supply of electricity from a mix of renewable or green energy sources. Through these programs, customers choose an amount of renewable or green electricity they would like to receive each month either in increments of kilowatt-hours or a specific percentage of their monthly electricity bill (U.S. Environmental Protection Agency, 2021).

On-Site Power Generation

Many people, when hearing the terms “renewable energy” or “green power”, think of images like solar panels on the roof of a building, powering the facility they sit on. This is the idea behind on-site green power generation: power is produced at or near the site of consumption. Many on- site power systems are “behind-the-meter,” meaning that the power production happens on the customer side of the utility’s electric meter and minimizes or eliminates reliance on the utility grid. In reality, on-site power generation often offsets a portion of utility-supplied electricity.

Most, if not all, transit agencies installing on-site power generation will still maintain a connection to the utility-operated electrical grid. The benefits of on-site power generation include the opportunity to produce greener energy than exists on the grid, possible financial savings from offset utility costs, and increased resiliency from grid outages. Successfully installing on- site power generation comes with a few challenges as well, although many transit agencies have successfully navigated these challenges to install their own on-site green power.

For agencies looking to procure green power in locations where a utility does not supply it, on- site power generation may be one of limited options. On-site green power generation provides environmental benefits by offsetting the need to burn fossil fuels for power and cutting down on the need for additional transmission and distribution infrastructure. The reduction in fossil fuel use leads to less local air pollution and less global greenhouse gas emissions. On-site generation can have financial upsides, as well. Once installed, all the power that is generated and then consumed by the agency is paying for the initial investment. Utility electricity rates often increase over time and offsetting those costs can have long-term financial benefits for transit agencies, especially if those agencies are deploying zero-emission buses and expecting a large, resulting increase in electricity usage.

In some jurisdictions, on-site power generation can even produce a net financial gain for an agency. Programs like net metering allow utility customers with on-site power generation to sell excess electricity generated by the on-site project back to the utility-owned grid, either at retail or at wholesale prices. These programs can help offset the initial costs of green power installations.

However, net metering programs often limit project eligibility. It is important to research programs in the relevant area and discuss the programs with the local electricity provider to fully understand the opportunities and constraints provided by these programs. For instance, the State of California limits net metering systems to 1 megawatt (MW) in size, and the total of all net metered systems’ capacity cannot produce more than 5% of a utility’s peak demand (U.S. Environmental Protection Agency).

Transit agencies considering on-site generation must be aware of the challenges and should plan their project carefully. Upfront costs for installation and commissioning of an on-site project is one major hurdle. Agencies must have enough capital to cover the initial expenses, including energy storage backups, utility infrastructure upgrades, and facility upgrades to handle the new power systems. Other costs may involve energy management software and training for staff. An agency looking to build on-site generation will likely need to discuss the project with a project developer, local permitting authorities, and the local electric provider to understand the costs of design, construction, permitting, and utility interconnection processes.

On-site generation also requires physical space, which may be at a premium for some transit agencies. Understanding the physical footprint of the desired power generation technology is important. After installation of the green power system, the agency will also need to cover maintenance and operations of the system or pay a third-party to do so. For more information on green power infrastructure requirements, please see Chapter 2: Green Energy Infrastructure.

Many transit agencies are considering or have installed on-site green power generation to power their operations. Owning and operating on-site generation provides many environmental benefits and can offer many financial and operational control opportunities. Successfully integrating on-site generation, however, requires careful planning, initial investment, and commitment to a continued maintenance and operational plan. Fortunately, other options to besides owning and operating on-site generation exist for transit agencies interested in green power for their operations.

Energy-as-a-Service (EaaS)

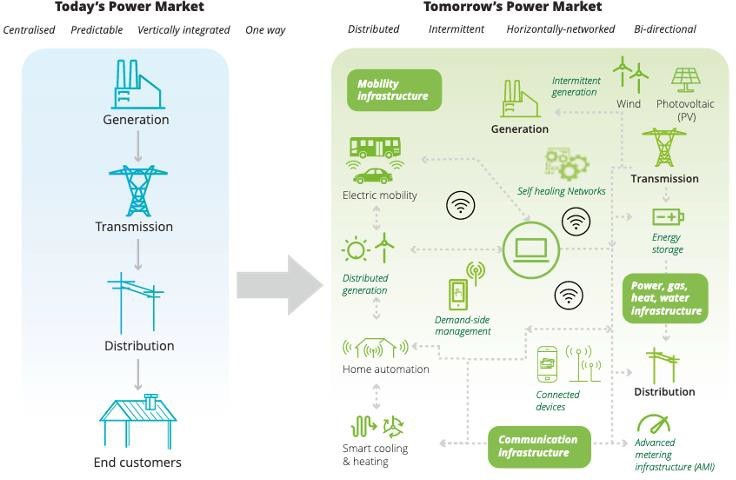

Traditionally, power generation has been centralized by highly regulated, vertically integrated utilities. The emergence of green energy technologies, like solar and wind, that can be installed in a more modular fashion have supported the creation of business models that take advantage of the more decentralized capabilities of these power production technologies. While the electricity industry has become more complex in many ways, there are also many new opportunities to access clean energy, manage energy consumption, and produce new revenue streams for both producers and consumers of electricity than there were in the historical vertically integrated system. These new opportunities are being captured by energy providers and often provided to customers, such as transit agencies, through energy-as-a-service models.

Energy as-a-service (EaaS) is the catch-all term for a category of business models that can provide green power to customers beyond what the local utility might offer. Typical EaaS models that transit agencies may be interested in are solar leasing, community solar, and power purchase agreements.

The general idea behind EaaS approaches is that a third-party develops, builds, and operates the green power production system (e.g. a solar power plant) and simply sells the power to a customer or group of customers. This transaction takes place outside of the typical utility-to- customer arena, although the utility may still be involved in delivering the power through utility- owned transmission and distribution lines.

Solar Leases

Solar leases are essentially a pay-for-output green power model. Solar leases have gained popularity in the residential solar markets, but could possibly work for a small transit agency. Under a solar lease, a solar company designs a solar power system to meet the customer’s needs, then installs and maintains the solar system at the customer’s facility at no upfront cost, supplying electricity for the duration of the contract. The solar company retains ownership of the power system and charges the customer for the output of the system. This business model works well for customers who do not want to pay the upfront cost of a system or do not want to commit to operations and maintenance of a green power system.

Community Solar

While typically emerging as an option for residential customers, community solar could be a green power procurement option for small transit agencies that can collaborate with other local businesses or residents to form a customer group and support a community solar project.

Community solar operates as a subscription model in which customers subscribe for solar energy delivery from a nearby solar (or other green energy) project. The community solar project is typically developed, owned, and operated by a solar company. Solar companies benefit from economies of scale in this scheme because the larger projects, supported by the subscribing customers, are less expensive per kilowatt to develop than individual solar installations (Resources for the Future, 2019).

Power Purchase Agreements

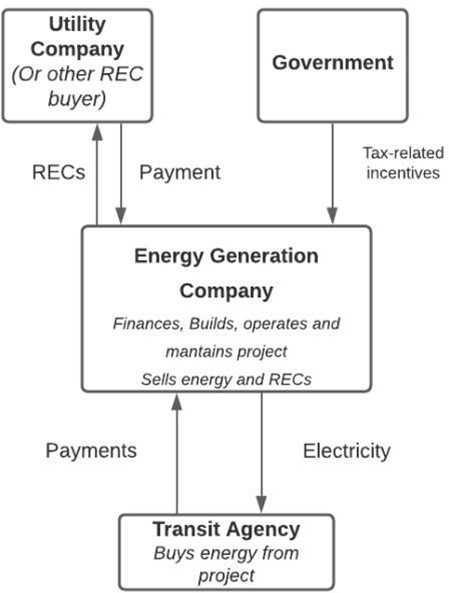

A power purchase agreement (PPA) is at its core a service agreement. In more detail, a PPA is a financial agreement where a third party (e.g. a solar generation company) usually owns, operates, and maintains an electricity generation system, and enters into an agreement with the customer (in this case, a transit agency) to provide the electric output from the system to the agency either on or off site.

Under these agreements the energy generation company is considered an independent power provider (when this provider is not a utility company), which enables the project to qualify for federal and state tax incentives (U.S. Department of Energy, 2011). These agreements provide options for lower cost electricity to the agency and revenue and tax credits for the supplier via Renewable Energy Credits (RECs) (see section on RECs below).

Types of PPAs

There are two types of PPAs, physical and virtual, depending on where the electricity was generated and delivered and the type of contract between parties.

A physical PPA is a long-term contract where the generator and the agency are in the same electricity market to allow for energy delivery. The contract specifies electricity prices with year-over-year escalation and includes details on electricity deliveries, schedules, and renewable energy credits.

A virtual PPA is a long-term contract where the generator and the agency are not necessarily in the same electricity market. The contract states long- term electricity prices, and electricity in itself is not directly delivered to the customer but put into the grid. This is a “contract for differences”—the difference between earnings and cost to the generator is transferred to the customer. If more is earned by the generator, then the difference is paid to the customer. If the generator makes less than the contracted price, then the difference is paid by the customer to the generator. The idea behind this type of PPA for green power is that the customer is paying to support and increase the proportion of clean energy being delivered to the grid.

Considerations for PPA Contracts

Under a PPA, a third-party finances, constructs, and operates the energy generation system, ensuring that energy delivery is performed as it was contracted. PPA contracts can include other clauses such as minimum outputs. Minimum output clauses establish that failure to deliver the contracted amount of energy may result in penalties to the generation company. Other contract details that may benefit the transit agency customer include fixed prices for energy and the possibility of establishing detailed management of price escalations, which help when budgeting for projects with longer lifespans.

The green energy produced by these PPAs is certifiable as such by the production of renewable energy credits. Ownership of these credits is negotiable by both the generation company and the agency, and may be sold separately from the energy distributed. More information on renewable energy credits is provided in the following sections.

As noted above, virtual PPAs are contracts for differences and the specific terms of the contract will dictate when an agency may have to cover energy price increases, for instance. Energy generated by renewable sources such as wind and solar can fluctuate, and the demand for energy might not be met by the PPA’s energy output. In this case, a separate traditional power agreement with the project site’s utility provider (i.e. a standard utility contract) can be used to ensure that this demand is met. In turn, this creates the possibility for two separate electricity bills and their associated administrative costs. These details are just a few of the numerous terms that must be considered in the somewhat complex challenge of negotiations and contract drafting between parties.

Renewable Energy Credits (RECs)

The U.S. Environmental Protection Agency defines RECs as “a market-based instrument that represents the property rights to the environmental, social, and other non-power attributes of renewable electricity generation.” Electricity flowing through the grid comes from a variety of sources—coal, natural gas, hydropower, solar, and others—and determining the exact resource an electron originated from after it reaches a customer delivery point is not possible. This fact posed a challenge for implementing renewable energy compliance regulations and programs. To solve the issue, a system of renewable energy certificates was developed to track renewable generation and delivery to the grid, providing a means of distinguishing renewable energy from fossil energy and serving as a tool for consumers and utilities.

RECs are used for environmental claims and can be used to claim eligibility for programs or financial incentives. Due to the characteristics of the tracking system, the tracked energy cannot be double counted or claimed by more than one party.

A REC is issued when one megawatt-hour (MWh) of electricity is generated from a renewable energy source and delivered to the grid. RECs are legal instruments and are tradeable. There are differences in state definitions for RECs but it is generally agreed that they verify the attributes of the energy from generation to point of use (U.S. Environmental Protection Agency, 2018).

There are two types of REC markets: compliance markets and voluntary markets. Compliance markets require electricity providers to produce a percentage of their generation from renewable sources. Voluntary markets are for RECs that are demanded because of client preference to use green energy but renewable energy use or production is not mandated by law.

RECs are issued by state or regional electronic trackers. The tracking agency issues RECs to registered generators that report verified generation to the tracking system.

If there is a generator that is not registered into a tracking system but provides RECs or energy attributes, then these RECs can be conveyed to another party via contracts. Generation must be measured and attributes verified, and ownership/attributes verification must be independently audited, which is also true for self-generation (U.S. Environmental Protection Agency, 2018).

Details on environmental claims, REC markets, and decisions surrounding them are beyond the scope of this paper. It is important to know that RECs and environmental claims are an important consideration when signing a contract for green energy, whether via a PPA or other contract type. A good resource for more information on environmental claims is the EPA website, Making Environmental Claims.

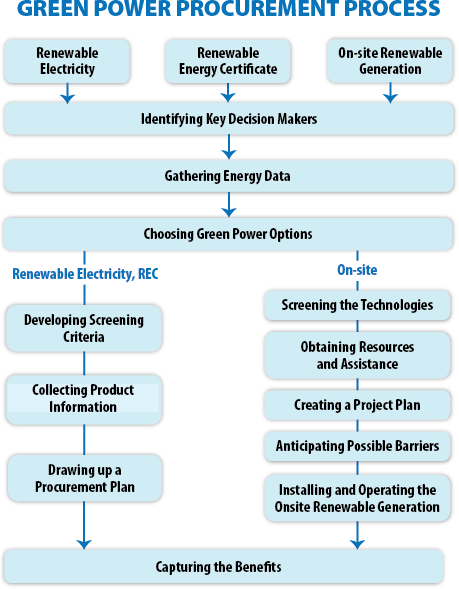

Procurement Process Flowchart

The following list and graphic provides a broad-strokes overview of the green energy procurement process and can be used as a guide for planning a green power procurement project. The information below is adapted from the EPA’s Guide to Purchasing Green Power.

- Identify key decisionmakers: For transit agencies, integrating green energy into operations will likely require decisionmakers from facilities and transit operations departments. Identifying all decisionmakers and stakeholders is important,

- Collect energy data: How much energy does the agency use right now? At what times of day does electricity use peak? How much will electricity use increase with zero-emission buses?

- Determine scope: Is your organization buying energy only for a particular project, a facility, or the entire agency?

- Evaluate the options: The availability of green power products varies by state and type of project. Green-e® offers an online search tool that helps simplify this step and locates renewable energy that meets EPA’s standards.

- Develop criteria: Agency- defined factors such as budget, green energy source, contract type or project length will serve as filters for the available options.

- Contact product providers: Once the providers have been pre-selected, contact them to determine current rates for renewable energy products. Some providers might offer other services in addition to energy delivery (e.g. demand management).

- Buy green power: When drafting contracts to buy green power, ensure that it clearly conveys the rights to make environmental claims from the energy purchased.

- Benefit from your purchase: EPA’s Green Energy Partnership allows for organizations to submit their energy purchase to qualify as Partners, who receive benefits such as assistance on press releases, Green Power Partner mark on websites and other communication materials (U.S. Environmental Protection Agency, 2021).